Want to know more about How Much Should I Contribute To My Hsa Reddit? Read this article to get the information you need.

In these times of skyrocketing healthcare costs, it’s more important than ever to plan for future medical expenses. One way to do this is through a Health Savings Account (HSA), a tax-advantaged savings account that can be used to pay for qualified medical expenses.

How Much Should I Contribute To My Hsa Reddit

But how much should you contribute to your HSA? That depends on several factors, including your age, health, income, and financial goals.

Determining the Right Contribution Amount

The annual contribution limit for HSAs in 2023 is $3,850 for an individual and $7,750 for a family. If you’re over 55, you can contribute an additional $1,000 as a catch-up contribution.

As a rule of thumb, you should aim to contribute as much as you can afford, up to the annual limit. The more you contribute, the more you’ll save on taxes and future medical expenses.

Factors to Consider When Choosing a Contribution Amount

When deciding how much to contribute to your HSA, consider the following factors:

- Age: The older you are, the more likely you are to have medical expenses. Therefore, it’s important to contribute more to your HSA if you’re closer to retirement.

- Health: If you have a chronic condition or a family history of health problems, you’re likely to have higher healthcare costs in the future. Again, contributing more to your HSA is wise.

- Income: The higher your income, the more you’ll benefit from the tax savings offered by HSAs. This is because HSA contributions are deducted from your pre-tax income, reducing your taxable income.

- Financial goals: If you’re saving for a down payment on a house or retirement, you may need to allocate your savings differently and contribute less to your HSA.

Tips for Contributing to Your HSA

- Set up automatic contributions: This is the easiest way to ensure that you’re contributing to your HSA regularly.

- Increase your contributions over time: As your income increases, you should aim to increase your HSA contributions.

- Use your HSA as a long-term savings vehicle: HSA funds can be invested and grow tax-free, making them an excellent way to save for future medical expenses or even retirement.

Frequently Asked Questions

Q: What are the benefits of contributing to an HSA?

- Reduces your taxable income

- Grows tax-free

- Can be used to pay for qualified medical expenses

- Can be rolled over to the next year if not used

Q: What are the qualified expenses that I can use my HSA to pay for?

- Doctor’s visits

- Dental and vision care

- Prescription drugs

- Medical equipment

- Long-term care premiums

Conclusion

Contributing to an HSA is a great way to save for future medical expenses and reduce your taxable income. The amount you contribute depends on your individual circumstances, but it’s a good idea to contribute as much as you can afford.

Are you interested in learning more about HSAs and how they can help you save for future medical expenses?

How Much Should I Contribute To My Hsa Reddit

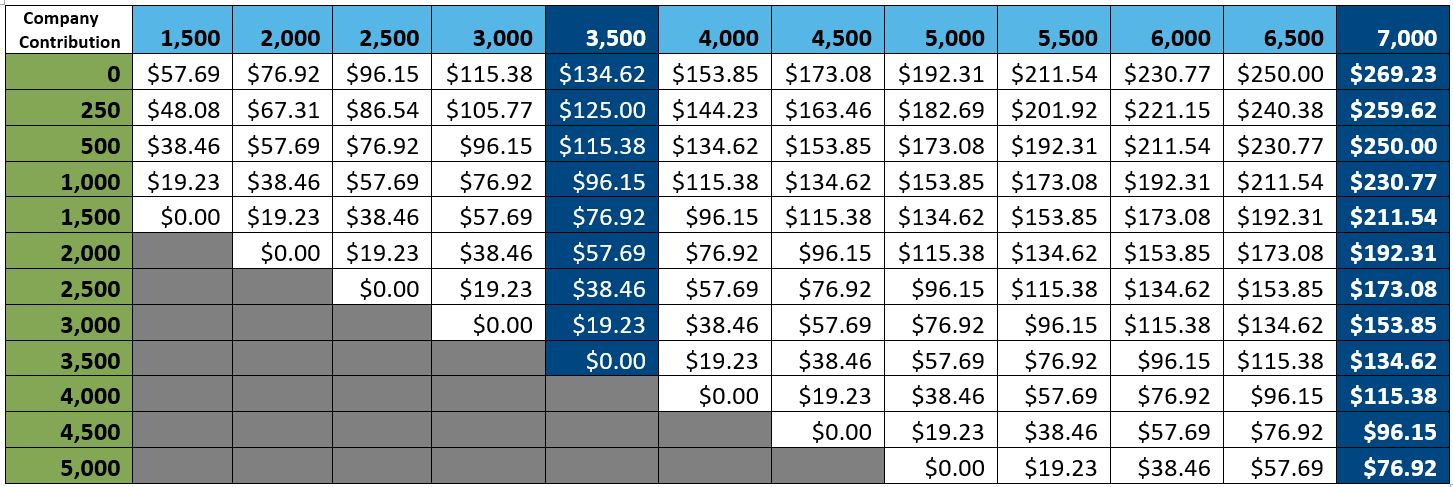

Image: www.financialfinesse.com

How Much Should I Contribute To My Hsa Reddit has been read by you on our site. Thank you for your visit, and we hope this article is beneficial for you.